Cha – ching . Cha – ching. Cha – ching.

Can you hear that? That’s the sound of your education racking up each year. Higher and higher it goes. Cha – ching. Cha – ching. Cha – ching.

One of the perks of teaching English overseas in countries like Korea or Japan is that you can pay down your student loan debt quickly. This is if you are a devout saver. I on the other hand have come to ask myself the question:

“Should I be saddled by debt and miserable paying it each month with no life?” Or, “Should I be saddled with debt and enjoy life?”

I chose the latter of the two. There is a difference between the two. For starters, if you were to pick the first option you would be struggling to enjoy life, because you are so worried of being straddled by debt your whole life you will devote all of your earnings to paying down your debt. This in turn leaves you no money to do anything else, but pay other bills and put gas in your car if you take a car to work. Some people can live this way, good for them.

I chose to be saddled by debt and pay what I can comfortably, while still being able to start a savings in case something happens that I need money, or if I want to go out and enjoy the little things in life. (Going out with friends for coffee, dinner, drinks, etc.) Now don’t let that fool you, I go out more now that I live abroad than I did when I lived in the states. However, I only go out two weekends a month, the rest of the time is spent at home by myself since I live in a small town.

So why talk about debt? Because it is an important conversation to have. When coming to teach English in a foreign country you realize the divide on living. Where some people are used to paying for everything (bills, loans, debt, etc.) and others have just graduated and don’t have to face debt for another 6-9 months, or not at all until they earn enough money,or they may have parental support back home during their stay abroad.

I’m not old, but I’m on the older half of English teachers during my intake. I have been paying my student loan debt for the last 6 years consistently. I have never made a grandiose payment on it. Why? I never landed a good job out of college. The first thing I did was move in with my boyfriend after I graduated. After looking for a job for 3 months, I took the first one that came my way because my savings was depleted. That job started me out at $6.55 an hour, until they moved me up to $7.25 two months later when they promoted me to a data entry operator. I paid every bill I could on my own (rent, groceries, credit card, student debt, repairs) you name it, I paid it on that small salary. I worked 40 hours a week, every time over time was offered I took it. I worked from 7:00 am until 10:30 pm and only took a half an hour break, because every penny counted for me. I couldn’t make large payments, I had to pay the minimum to get by. I looked for other jobs along the way and I tried to change careers, but ultimately I left my job when the stress of working harder than everyone else and receiving blame for something I didn’t do made me walk out. I did a part-time job through Christmas and moved home early next spring when my savings was gone. I found a job almost 2 months later as a bank teller making $9.75 an hour. I stayed at that job for almost 4 years and in that time the highest my pay ever got to was $11.33. I worked 6 days a week (only two saturdays a month were mandatory) and I worked one sunday a month, because saturday and sunday were overtime and double time. I needed money, so I always worked and I had no life. I wasn’t making a lot of headway with my bills either.

Later on top of paying my own student loan debt, credit card bills, car insurance, gas, repairs, groceries, cell phone bill, and the house water and electric bill, my savings started to become less each month. And I realized it was time to leave my job and do what I always wanted, to teach English abroad. For me, I work only 5 days a week and I now make more money. The situation has reversed itself.

At some point you look at your student loan debt and go, you know…its just another bill. It comes every month like the electric bill or cell phone bill and guess what? You need to pay it. I have had to live off of credit cards for gas and groceries so I could pay my student loan bills. Because I refused under any circumstance to default on them. I also refused to reach out for help from my parents, because it was my own financial responsibility. Though in a pinch when I really couldn’t make ends meet I had asked once.

I thought about this a lot today, because I finally just paid off one credit card. I have one more to go. ( The next credit card I have not used in the last 6 months.) I wanted to reassess my debt situation. How much do I owe? Sometimes I sit and crunch unrealistic numbers. Like if I pay x amount per month, I will pay this off in x amount of time. And then I realize I have no extra money or life if I do that. Looking it over I feel slightly depressed, I realize I have at least another 7 years to go to pay off my student loan debt. My mom makes one payment a year for me on my biggest loan and I appreciate that more than I can say. When I think things over, I pay cash for all the important things in life. Vacation is always paid in cash. My wedding I paid entirely in cash. My living expenses between jobs for a few months is always in my savings when I decide to make a career switch. I plan ahead that way.

My goal now is not to touch that credit card but to pay it down in a quick manageable way. I always look at others who make more money or received help for their loans and they are debt free now. They are lucky and I hope they are thankful if they received help. The average student loan debt as of 2012 supposedly was around $23,000. That is the size of my private loan I took out for the 2006 -2007 school year.

I was lucky in that when I applied to the University of Massachusetts-Amherst, my major at the time, Japanese, was not offered in any public university in my home state of Connecticut. So my tuition was as much as in-state tuition plus $1,000 for the first two years. Instead of paying $26,000/year I was paying $14,000/year. When I realized I wasn’t studying hard enough for my major and was going to end up being a 5 year student, I switched my major to Anthropology. My tuition for the following year spiked up to $27,000. I had a mini panic attack inside and tried to figure out the fastest way to graduate. I had managed to apply for a short summer semester abroad at Yonsei University with my junior year federal loan. Unfortunately for me, because I always took extra credits every semester and I took winter session and then summer session my status was flexible. I was a junior my first semester my final year and a senior the second semester. But because schools only issue aid for one school year I never could get help with another government loan and had to take a private one.

The weight of my student loan debt made me hurry and graduate and I regret that. Because I would have taken different classes and had two minors had I stayed one more semester or even a year. Debt is a scary thing. Capitalized debt on a private loan from the devil, Salliemae, will make you wince as well. So 6 years later, where am I? I still owe $23,226.56 to the government and Salliemae. I have paid half of my loans, only half more to go!

The thing about having debt abroad is, if you so choose to you can pay it down quickly. Or you can pay what you were paying and still be able to have fun and travel, because your overhead cost for living is minimized. The only bills I pay for in my apartment are water, electric, and gas. And they do not amount to much each month. For example, my water bill is roughly $4 a month. My electric bill is roughly $8. And my gas bill which I paid for four months in advance was about $36. That is a huge difference compared to back home.

If you are young and just getting out of school, it is definitely worth trying since you have a 6-9 month grace period before you have to start repaying your loans. If you are like me and are already an established loan repayer, you need a little extra back home to tie you over until you get that first paycheck. The first thing I do when I get paid on the 25th of every month is move all the money I need to pay bills back home. Nothing fun happens until my money is wired back, because bills come first.

Here are some fun photos I found.

This picture is funny in if you take the fact that Generation Y (Millennials) born from 1980 -2000 (if you use those years). We are slightly larger than the baby boomer generation. Something to think about.

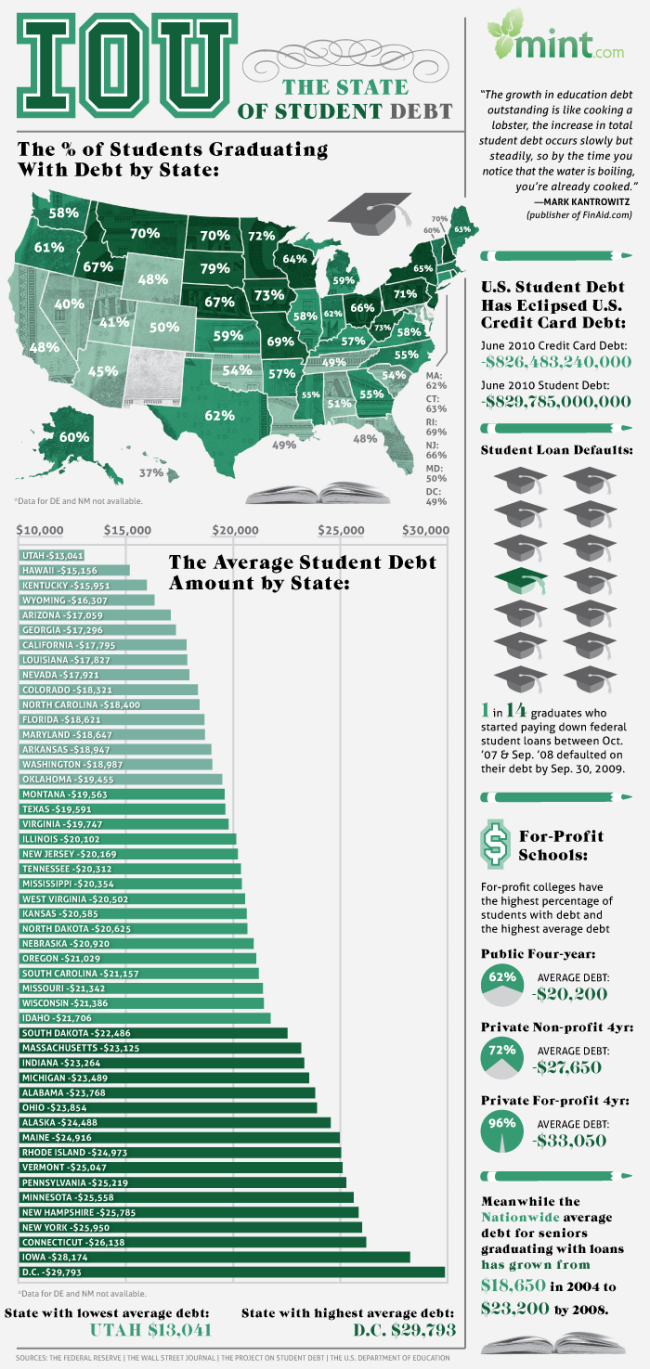

This infograph shows the average debt per state in the United States. No surprise that all the New England states are on the higher end.

Kind of how we all feel about debt.

The thing about being the oldest in my family and the first to go to college is my sisters learned from me. I didn’t stand out so I never qualified for many scholarships. But my younger sisters looked for scholarships and affordable school programs. My youngest sister is currently paying her way through her master’s program, though she too has student loan debt, albeit less than mine. My middle sister learned the most from me, she didn’t want debt and has continuously worked her way through community college and became an LPN through a private program. However, I believe it is close to being paid off or now is. She is back at community college paying for her prerequisites to become an RN. So sometimes your debt can become a learning curve for other members of your family.

I, myself, have always wanted to go back to school and do a master’s. The only thing holding me back is money. I don’t know if I want to increase my student loan debt. What would I get a master’s in? I’m not about to throw away money for something I may not use. So I sit and I debate this, do I go back? Will I go back? As I work different jobs, I find what I like and what I don’t like. Currently, I really like what I am doing. I like teaching, so at some point I may get a master’s in education or ESL so that I can increase my qualifications, but that is some point in the far future.

How are the rest of you living abroad with debt doing? Any tips or tricks? Or any lifestyle choices that you make? Do you pay your loans quickly or what you can afford? I would be curious to know.